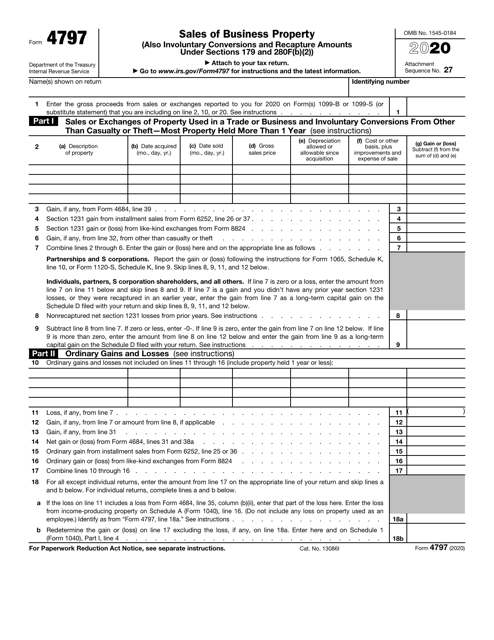

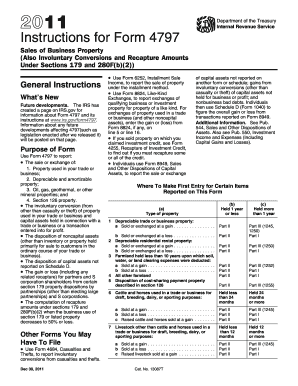

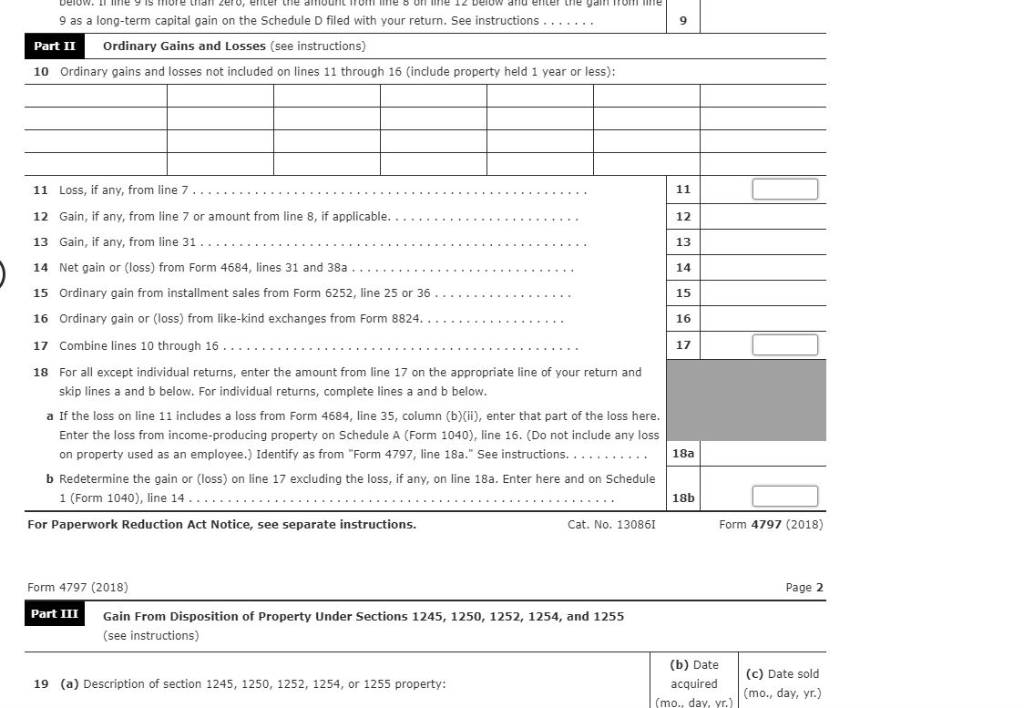

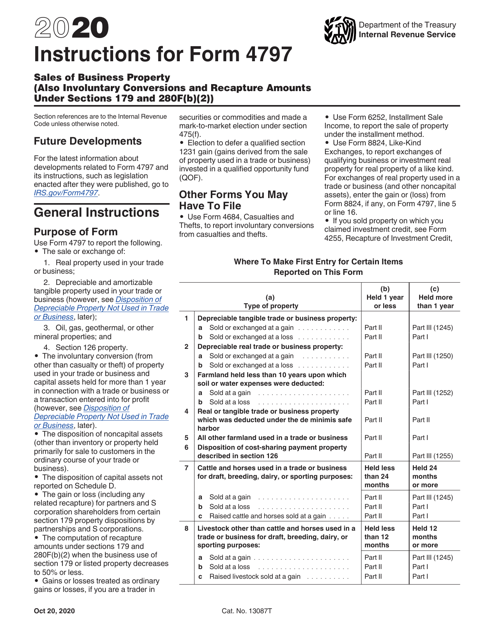

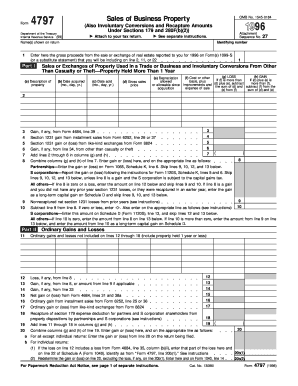

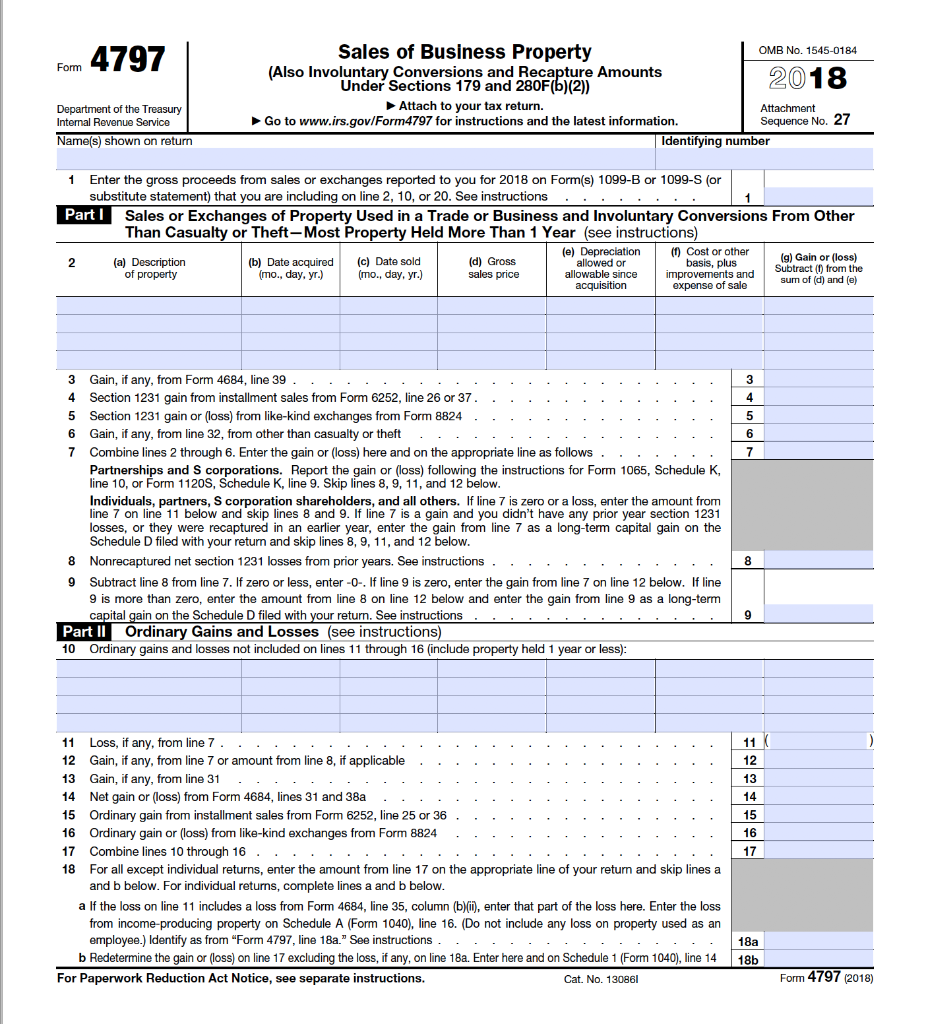

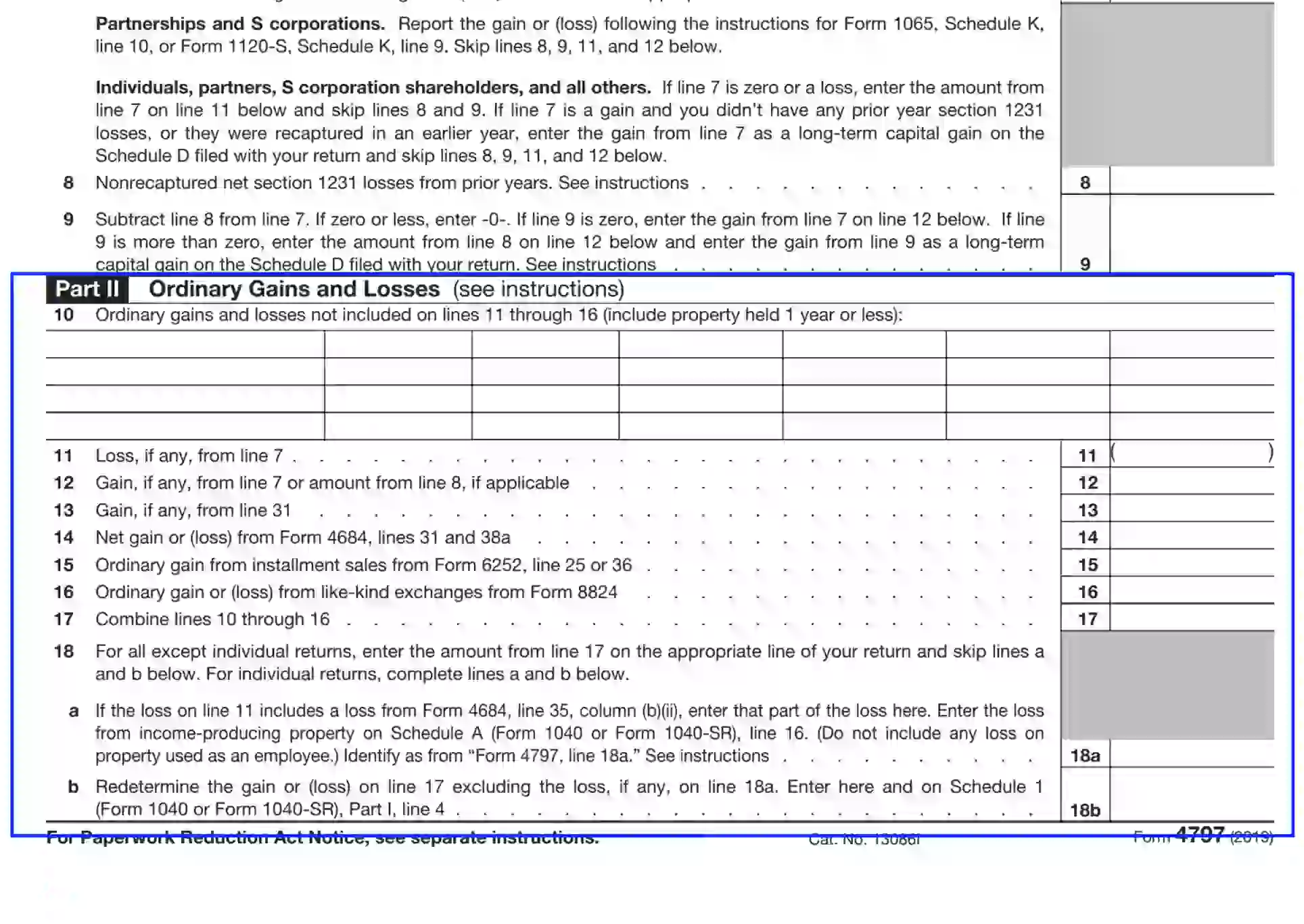

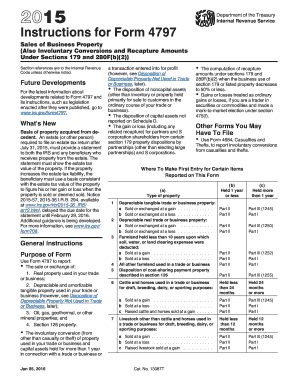

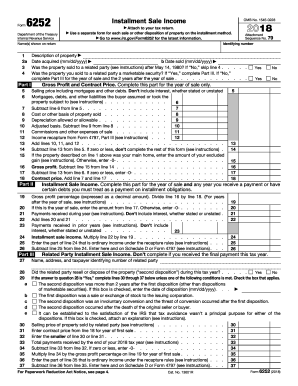

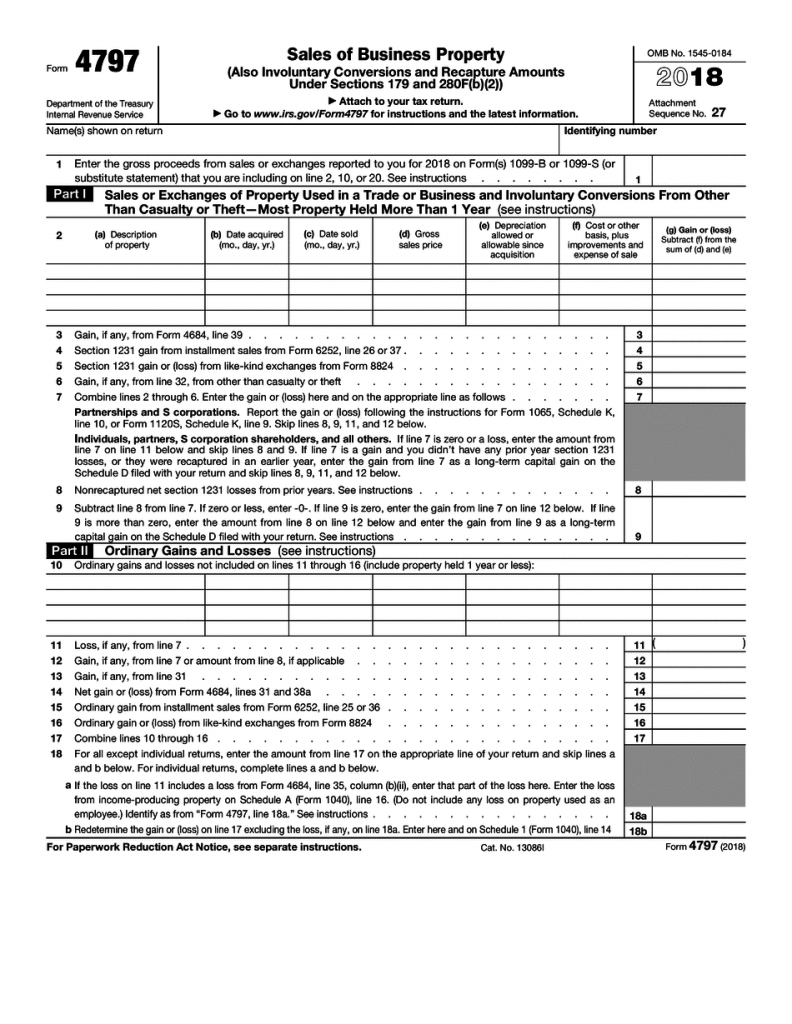

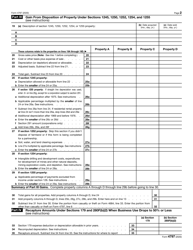

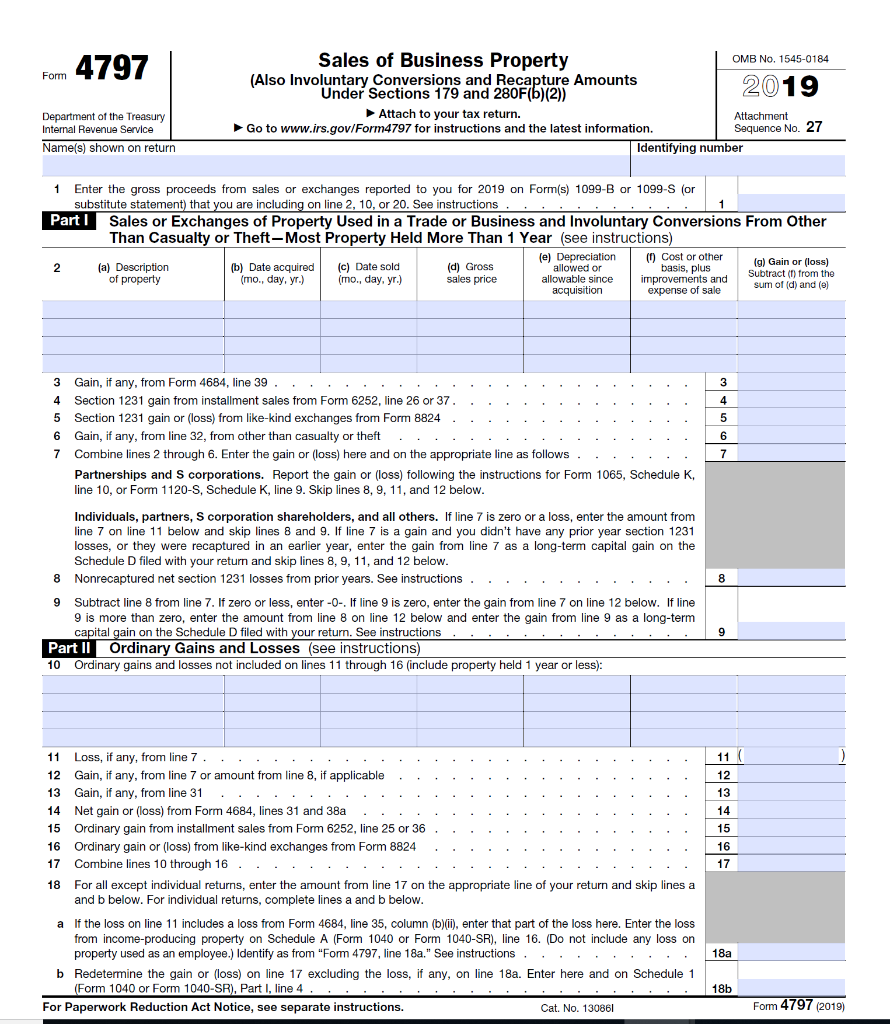

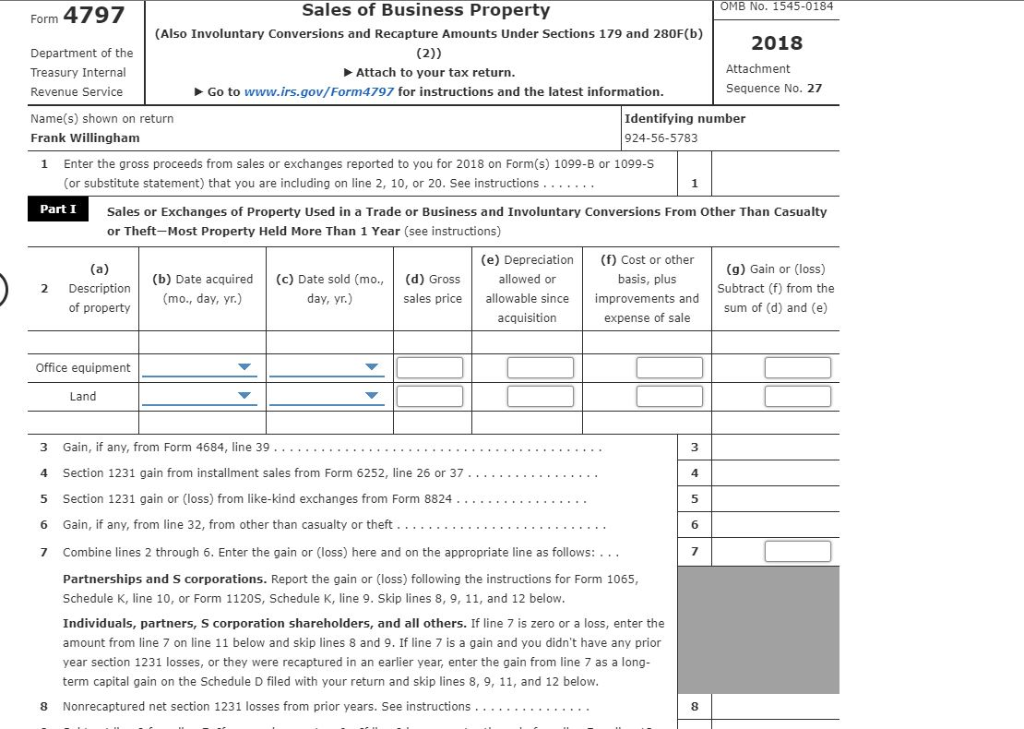

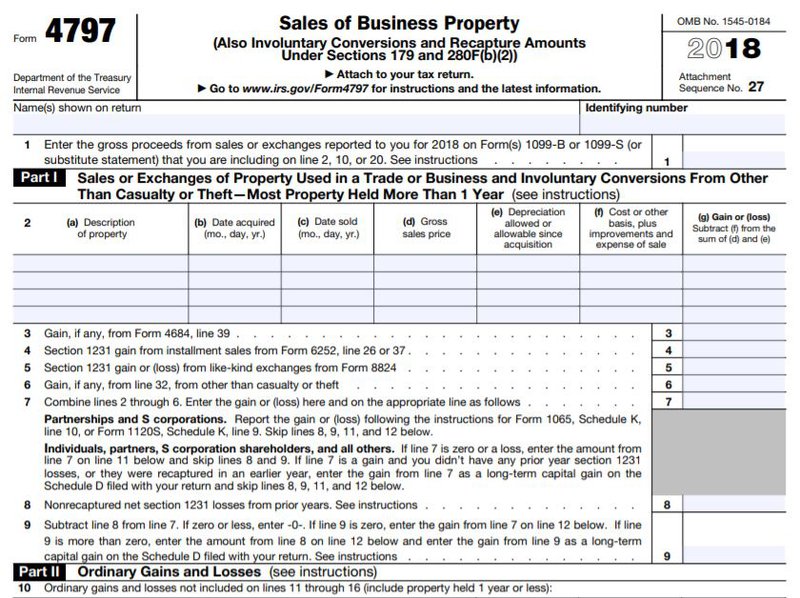

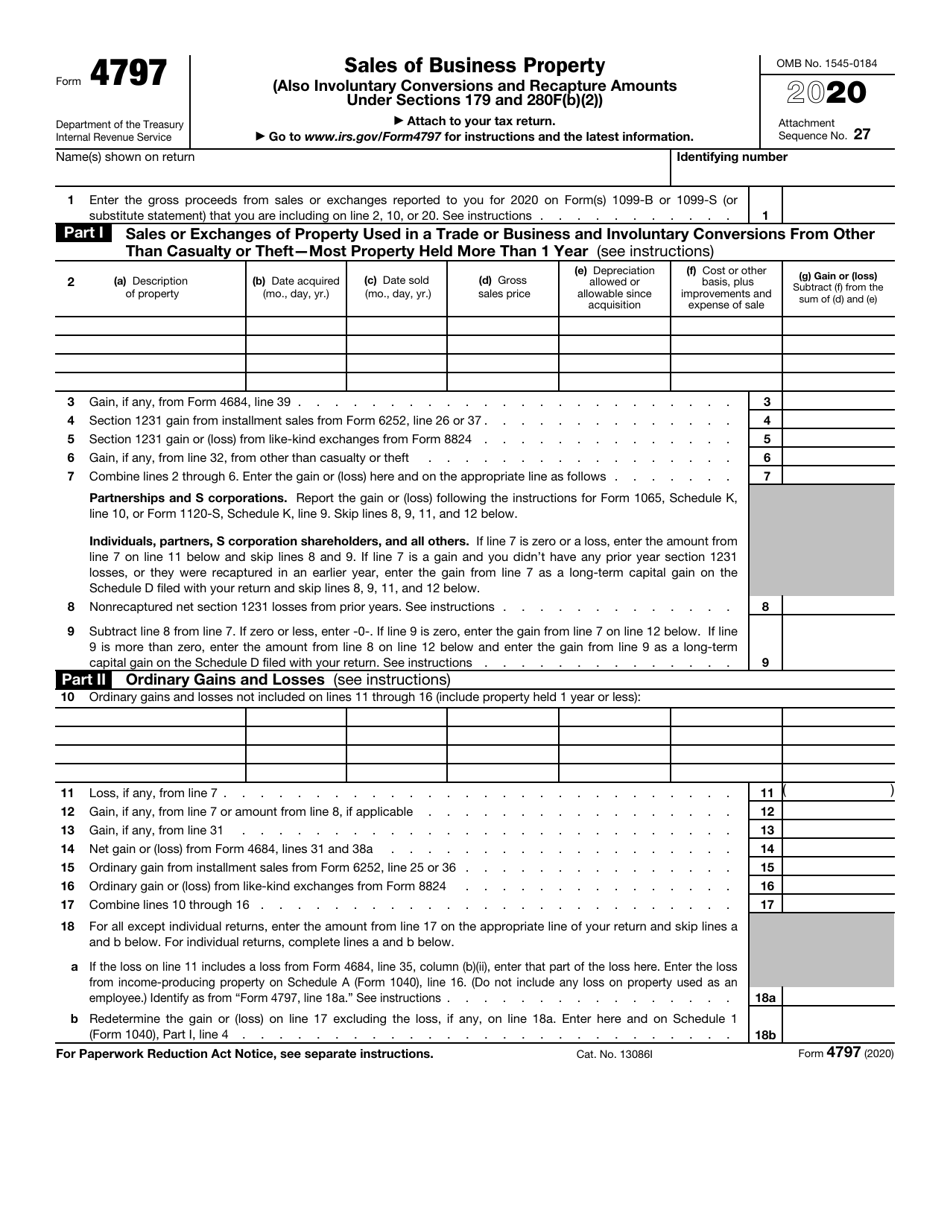

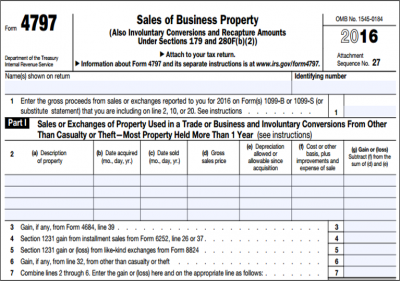

This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information as a courtesy Do not file draft forms Cat No I Form 4797 (18) DO NOT FILE September 6, 18 DRAFT AS OF Form 4797 (18) Page 2Get And Sign Irs Form 4797 Instructions 1521 Acquired from de cedent An estate (or other person) required to file an estate tax return after July 31, 15, must provide a statement to both the IRS and any beneficiary who receives property from the estate The statement must show the estate tax value of the property18 Instructions for Form 4797 Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments For the latest information about

Free 18 Printable Tax Forms

Irs form 4797 instructions 2018

Irs form 4797 instructions 2018-Jul 30, · Form 4797 is a tax form to be filled out with the Internal Revenue Service (IRS) for any gains from the sale or transfer of property that was used for business purposes This can include but is not limited to any property that was used to generate rental income or a home that was used as a businessSignNow combines ease of use, affordability and security in one online tool, all without forcing extra software on you All you need is smooth internet connection and a device to work on Follow the stepbystep instructions below to esign your form 4797 example

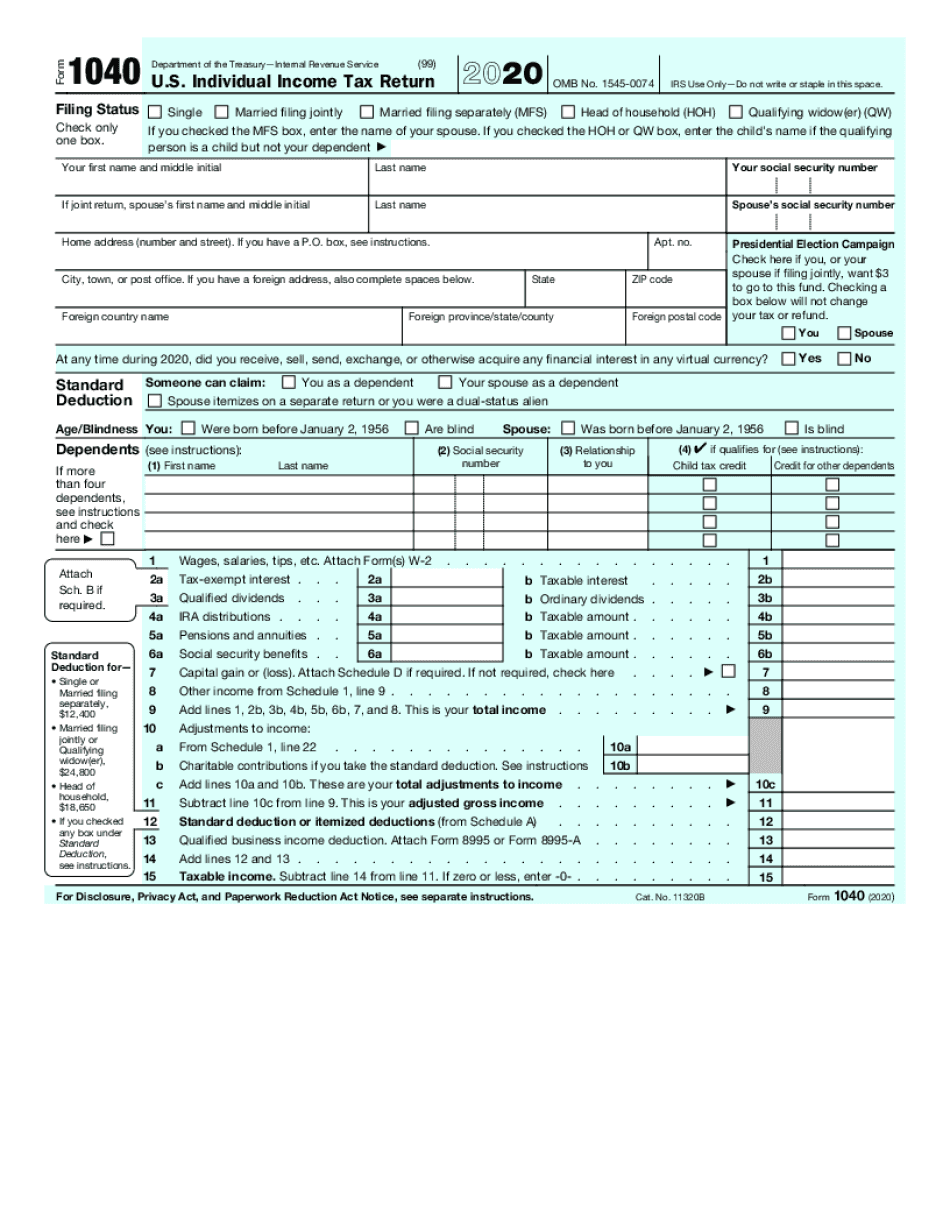

Completing Form 1040 With A Us Expat 1040 Example

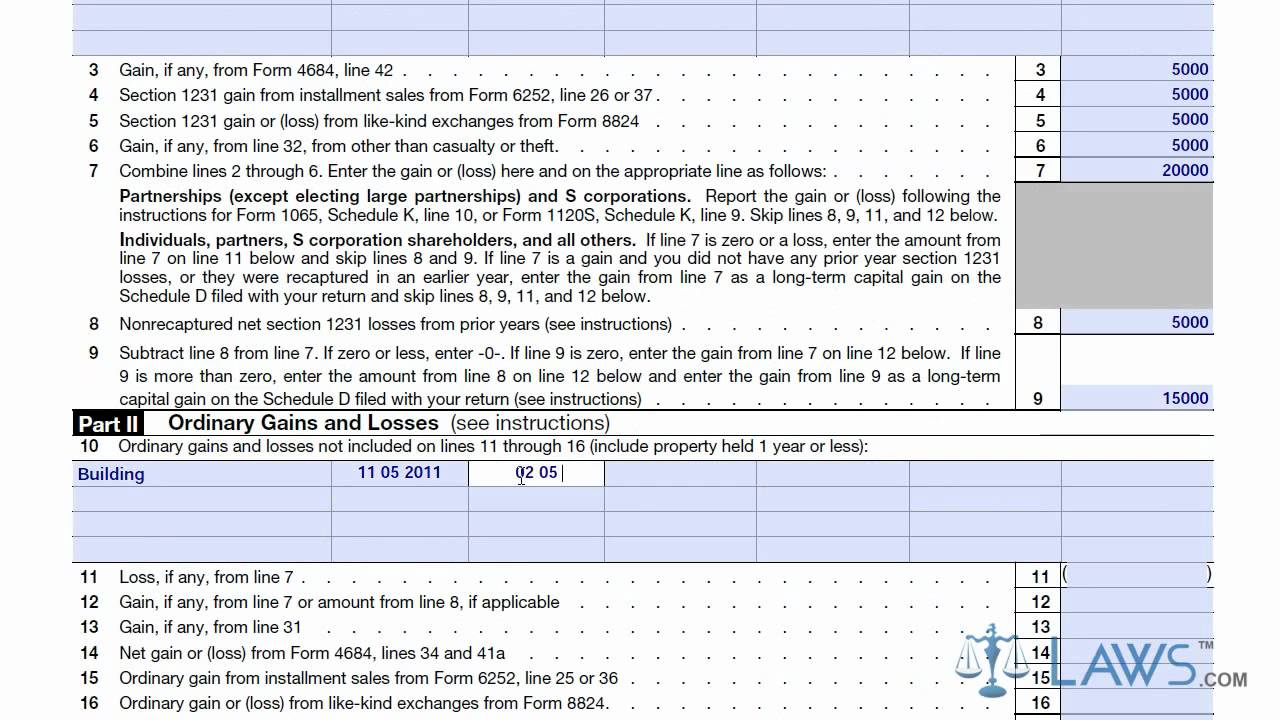

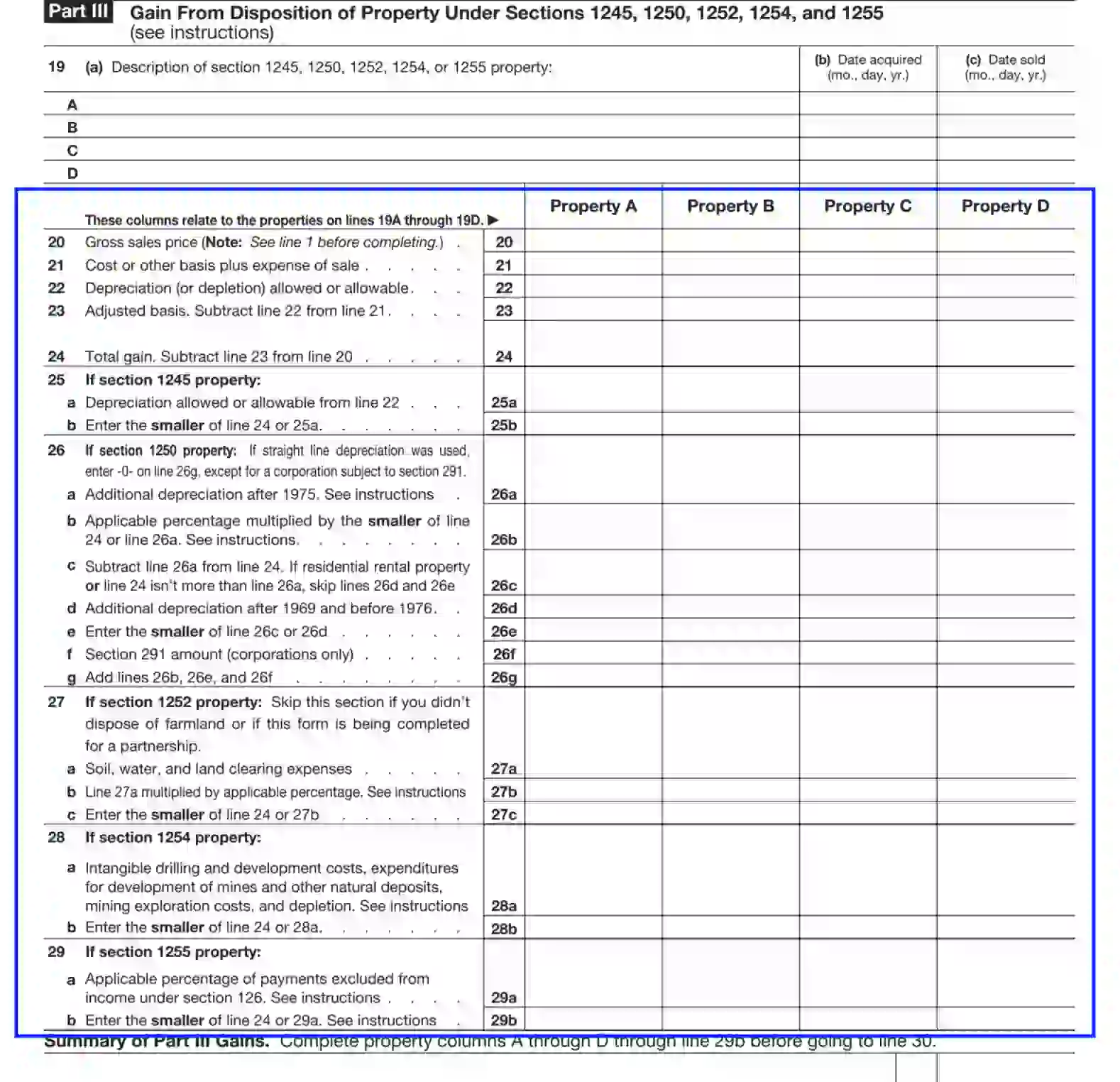

If you have not entered an asset for depreciation, the screen to enter a loss on Part II of IRS Form 4797 will not appear If you need to enter a loss on Form 4797 Part II, use the instructions below to add the necessary information TaxACT Online Click on the Forms tab on the right side of the screen, then select View complete Forms listThe shareholder's share of the cost or other basis plus the expense of sale (reduced as explained in the instructions for federal Form 4797, line 21) The shareholder's share of the depreciation allowed or allowable, determined as described in the instructions for federal Form 4797, line 22, but excluding the IRC Section 179 expense deductionFollowing the Instructions for Schedule K1, enter any amounts from your Schedule K1 (Form 11S), box 9, or Schedule K1 (Form 1065), box 10, in Part I of Form 4797 If the amount from line 7 is a gain and you have nonrecaptured section 1231 losses from prior years, see the instructions for line 8 below

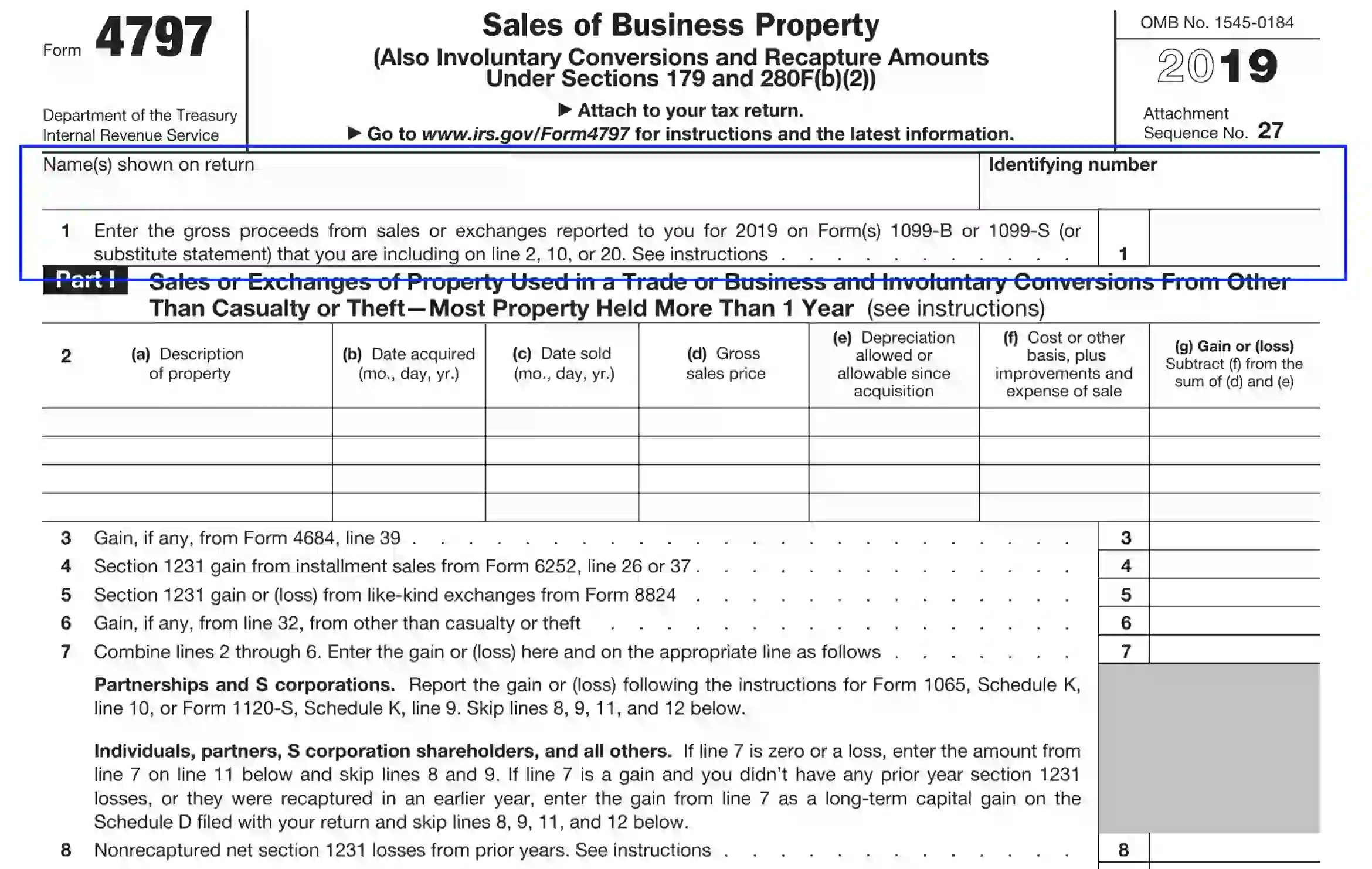

Oct 15, 19 · Line 1 of 4797 states "Enter the gross proceeds from sales or exchanges reported to you for 18 on Form(s) 1099B or 1099S (orsubstitute statement) that you are including on line 2, 10, or See instructions " Two questions 1 I am correct in saying Line 1 of 4797 should have the value stated in the 1099s of the property soldJan 07, 21 · Instructions for How to Complete IRS Form 4797 Filling the IRS form 4797 is easy and can be done very fast using the PDFelement However, the following steps given below will guide you to complete this form Step 1 First of all, you can get this form from the department of treasury or you can just download it from their official website18 Instructions for Form 568 References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 15, and to the California Revenue and Taxation Code (R&TC) In general, for taxable years beginning on or after January 1, 15, California law conforms to the Internal Revenue Code (IRC) as of January 1, 15

To generate Form 4797, use one of the following methods Method 1 To generate Form 4797 from the 4562 screen, use the IF SOLD section of the screen Date Sold and Property Type are required entries;Inst 4797 Instructions for Form 4797, Sales of Business Property « Previous 1 Next » Get Adobe ® ReaderPage 1 of 11 1353 18Jan18 The type and rule above prints on all proofs including departmental reproduction proofs MUST be removed before printing 17 Instructions for Form 4797 Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Department of the Treasury Internal Revenue

Form 49 Instructions Information On Capital Gains Losses Form

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

18 Instructions for Form FTB 3514 California Earned Income Tax Credit Revised 04 Enter the gain from federal Form 4797 Sales of Business Property, line 7 If the amount on that line is a loss, enter 0 a 18 tax return or is filing a 18 return only to claim a refund of withheld income tax or estimated tax paid Get federalJun 01, 19 · Hello all, I am trying to figure out how to fill out form 4797 for the tax year 13 The duplex was purchased in 07 for $240,000 and sold in 13 for $251,900 It was used as a rental property the entire time and was never owner occupied Here are the facts Purchased in 07 for $240,000 (Land 50,000 Building 190,000) Sold in 13 for $251,90059 Sales or use tax as reported on your original return (see instructions Do not leave line 59 blank) 59 00 New York City and Yonkers taxes, credits, and surcharges and MCTMT Voluntary contributions as reported on your original return (or as adjusted by the Tax Department;

S C H E D U L E D F O R M 1 0 4 1 2 0 2 0 Zonealarm Results

What Is Irs Tax Form 6252

Form 11CM (18) Page 4 Schedule K Other Information (see instructions) 1 Check accounting method a Cash b Accrual c Other (specify) Yes No 2 See the instructions and enter the a Business activity code no b Business activity c Product or service 3 If "Yes," enter name and EIN of the parent corporation 4 At the end of the tax year a Did any foreign or domestic corporation,How to complete any Form Instructions 4797 online On the site with all the document, click on Begin immediately along with complete for the editor Use your indications to submit established track record areas Add your own info and speak to dataINSTRUCTIONS MARYLAND FORM 505X 18 COM/RAD 022A exclusions, credits, deductions or adjustments may be dis A claim filed after three years, but within two years from the A claim for refund based on a federal net operating loss If the claim for refund or credit for overpayment resulted from If the Internal Revenue Service issues a final

What You Need To Know About Form 4797 Millionacres

Form 4797 Fill Out And Sign Printable Pdf Template Signnow

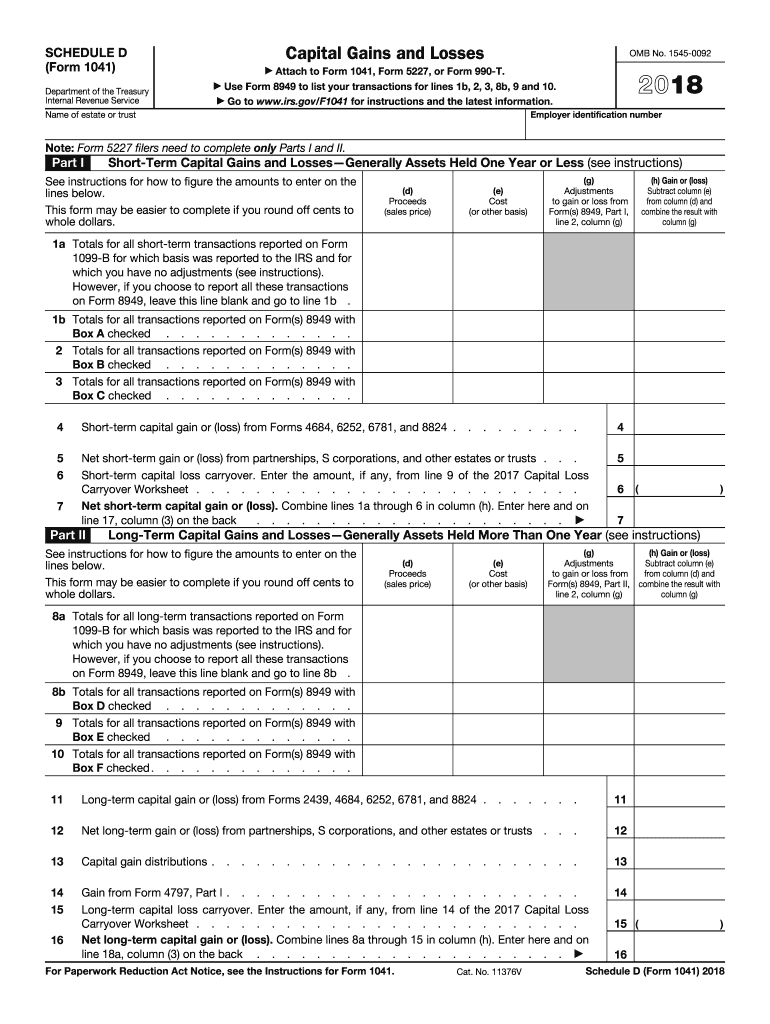

Enter the gross proceeds from sales or exchanges reported to you for on Form(s) 1099B or 1099S (or substitute statement) that you are including on line 2, 10, or See instructionsMay 12, 21 · Read through the IRS form 49 instructions so that you can fill the form accurately and avoid penalties You must fill Form 49 before you complete line 1b, 2, 3, 8b, 9, or 10 of Schedule D In cases where you lost or did not keep records to determine your basis in securities, contact your broker for assistanceAlso use Form 6252 to report any payment received during your 18 tax year from a sale made in an earlier year that you reported on the installment method Enter gain from the installment sale on Form 4797, line 4 or line 15, as applicable See the Instructions for Form 6252

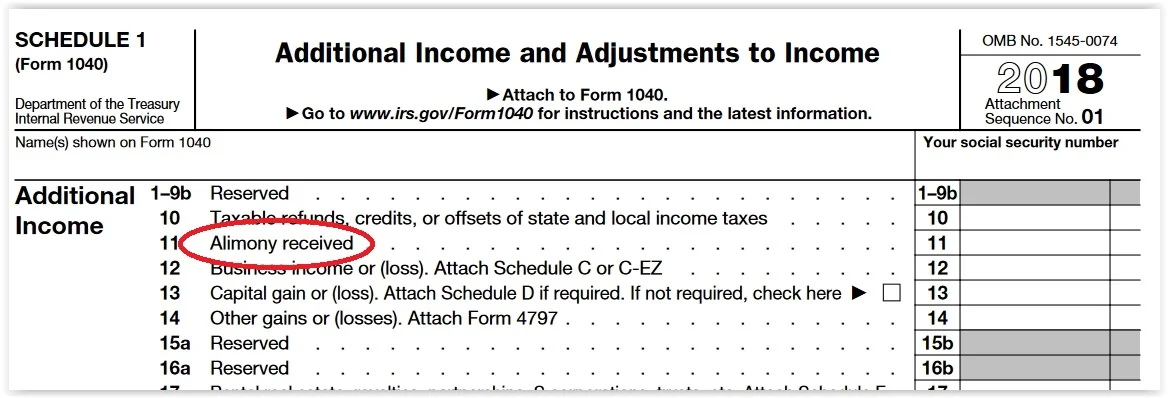

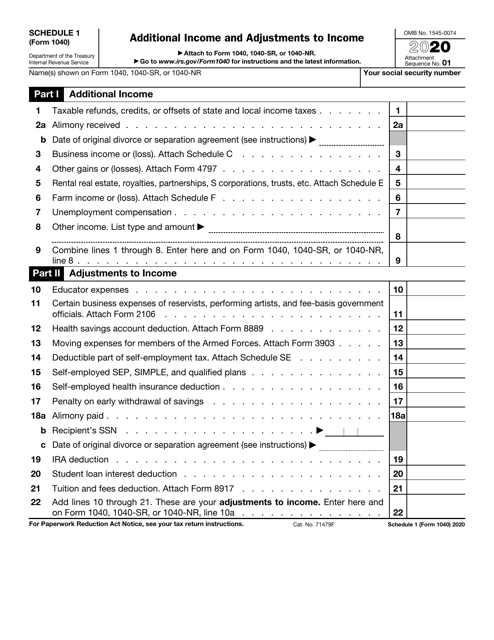

Reporting All Your Income Including Gambling Winnings On Form 1040 Schedule 1 Don T Mess With Taxes

White House Orders Irs To Pay Tax Refunds Despite Government Shutdown Kvue Com

18 Individual Income Tax Forms and Instructions Underpayment of Estimated Income Tax Instructions included on form MI461 Michigan Excess Business Loss Due to the federal CARES Act this form is no longer available Instructions included on form MI4797 Adjustments of Gains and Losses From Sales of Business PropertyInternal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments For the latest information about developments related to Form 4797 and its instructions, such as legislation enacted after they were published, go to IRSgov/Form4797 General Instructions Purpose of Form Use Form 4797The way to complete the IRS Instruction 4797 online Click the button Get Form to open it and start modifying Fill in all needed lines in the selected file utilizing our advantageous PDF editor Turn the Wizard Tool on to complete the process much easier

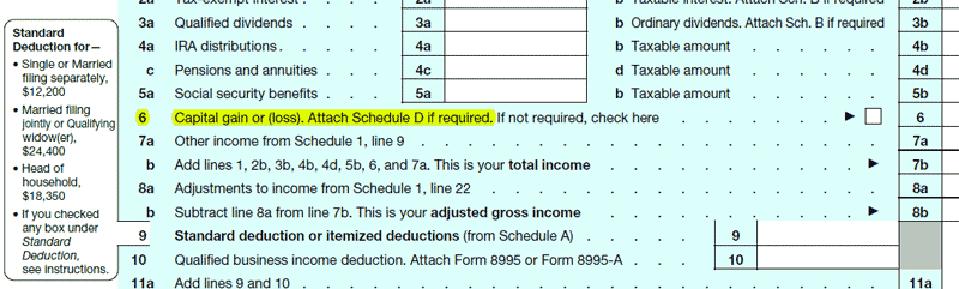

Completing Form 1040 With A Us Expat 1040 Example

Completing Form 1040 With A Us Expat 1040 Example

Feb 24, 21 · Mary McMahon Date February 24, 21 From 4797 is used to report transfers, losses and gains associated with business property Form 4797 is a document required by the Internal Revenue Service in the United States when people transfer business property or experience gains and losses related to such propertyThis document must be filed along with other taxGet And Sign Irs Form 4797 1721 Part I 1 Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft—Most Property Held More Than 1 Year (see instructions) (a) Description of property 2 (c) Date sold (mo, day, yr) (b) Date acquired (mo, day, yr) (e) Depreciation allowed or allowable since acquisition (d) GrossForm 18 Supplemental Income and Loss (IRS) Form 18 Profit or Loss From Business (IRS) Form 18 Net Profit From Business (IRS) Form 11 US Corporation Income Tax Return (IRS) Form 11H for Homeowners Associations US Income Tax (IRS) You may file Forms W2 and W3 electronically (IRS) Form Allocation of Refund

Calculation Of Gain Or Loss Section 1231 Gains An Chegg Com

Download Instructions For Irs Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Templateroller

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features Press Copyright Contact us CreatorsJun 29, 18 · IRS Form 4797 Overview Before we go any further with reviewing and understanding form 4797, it's a good idea to take a moment to discuss what it is and what it's used for Put simply, IRS form 4797 is a tax form that's used specifically for reporting the gains or losses made from the sale or exchange of certain kinds of business propertyInstructions for Form 4506A, Request for Public Inspection or Copy of Exempt or Political Organization IRS Form 0121 01/21/21 Form 4506C IVES Request for Transcript of Tax Return 09 Form 4506F Request for Copy of Fraudulent Tax Return 0319 04/24/19 Form 4506T Request for Transcript of Tax Return

Actg068a Solution Hw 3 18 Form 4797 Pdf Form 4797 Sales Of Business Property Omb No 1545 0184 Also Involuntary Conversions And Recapture Amounts Course Hero

Completing Form 1040 With A Us Expat 1040 Example

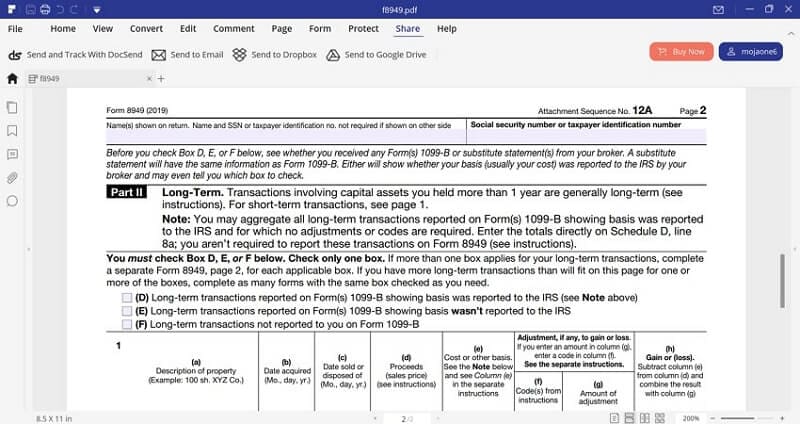

Aug 01, 19 · Enter Ordinary Gains and Losses, Form 4797 Part II Some of the assets sold with my business were owned under one year (and expensed) or otherwise need to be reported as Ordinary Gains and Losses18 Inst 4797 Instructions for Form 4797, Sales of Business Property 18 Publ 4810 Specifications for Electronic Filing of Form 55SSA, Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits 18 Form 45 Farm Rental Income and Expenses 18 Form 4852Form 4797 and Form 49 If you sold assets from a passive activity or you sold an interest in your passive activity, all gains from the activity must be entered on the appropriate line of Form 4797 or Form 49 Identify the gain as "FPA" Enter any allowed losses for Form 4797 or Form 49 on the appropriate line

Irs Form 38 How To Fill It With The Best Form Filler

Form 11s U Income Tax Return For An S Corporation Omb No 18 Internal Revenue Service Gt Go To Www Gov Form11s For Instructions And The Course Hero

Computation of Credit for Gift Tax 1116 Inst 4797 Instructions for Form 4797, Sales of Business Property Form 4797 Sales of Business Property Inst 4768 Instructions for Form 4768, Application for Extension of Time To File a Return and/or Pay US Estate (and GenerationSkipping Transfer) TaxesJun 04, 19 · This worked for me, but please note that I submitted the required "election" statement with my 19 return via certified mail, and sent in the Form 3115 with the tax return this year, with all trades delineated on IRS Form 4797 and plus pages of supplemental trades (one line for each transaction) which I kept in a spreadsheetThe disposition of each type of property is reported separately in the appropriate part of Form 4797 (for example, for property held more than 1 year, report the sale of a building in Part III and land in Part I) For more information, refer to the IRS Form 4797, Sale of Business Property, Instructions

The Mystockoptions Blog Tax Forms Irs

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Use Form 4797 to report The sale or exchange of property The involuntary conversion of property and capital assets The disposition of noncapital assetsComputation of Credit for Gift Tax 1116 Inst 4797 Instructions for Form 4797, Sales of Business Property Form 4797 Sales of Business Property Inst 4768 Instructions for Form 4768, Application for Extension of Time To File a Return and/or Pay US Estate (and GenerationSkipping Transfer) TaxesThis document contains official instructions for IRS Form 4797, Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280f (B) (2)) a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the US Department of the Treasury

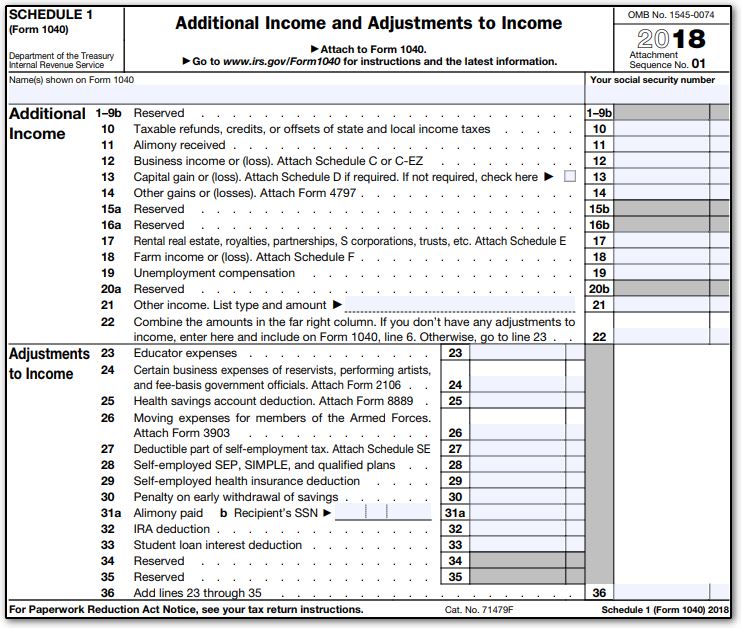

1040 Schedule 1 Drake18 And Drake19 What Does Form 1040 Schedule 1 Look Like And What Is It Used For The Tax Cuts And Jobs Act Changed The 1040 And Many Supplementary Schedules Were Added Schedule 1 Shows Additional Income And

Form Irs Instruction 4797 Fill Online Printable Fillable Blank Pdffiller

Get And Sign Irs Instructions Form 4797 1021 Capital gains invested in Qualified Opportunity Funds If you have a capital gain in 18, you can invest that gain into a Qualified Opportunity Fund and elect to defer part or all of the gain that you would otherwise include in income until December 31, 26Sales of Business Property Form 4797 Form 4797 Department of the Treasury Internal Revenue Service Sales of Business Property OMB No Attach to your tax returnMethod 2 Enter only a Date Sold on the 4562 screen, then complete the 4797 screen Be sure to include allowed or allowable depreciation Method 3 Enter data on the 4562 to recapture

Fill Free Fillable Sales Of Business Property Pdf Form

Irs Federal Tax Form 1040 Types Schedules Instructions

See instructions) Page 4 of 6 IT1X (18) Your social security numberAttachment 16 Reported on US Form 4797 To be filed with Form MI1040 or MI1041, see instructions Filer's Name Shown on Tax Return Identifying Number PART 1 Sales or Exchanges of Property Used in Trade or Business and Involuntary Conversion From Other Than Casualty or Theft Property Held More Than One Year 118 Attachment Sequence No 27 Name(s) shown on return Identifying number 1 Enter the gross proceeds from sales or exchanges reported to you for 18 on Form(s) 1099B 1099S (or substitute statement) that you are including on line 2, 10, or See instructions 1 Part I

Form 4797 Fill Out And Sign Printable Pdf Template Signnow

Solved How To Report These On Schedule D Tax Return James Chegg Com

Feb 08, 18 · irs 4797 18 for a onesizefitsall solution to esign form 4797?

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)

Irs Form 49 Definition

Form 11s U Income Tax Return For An S Corporation Omb No 18 Internal Revenue Service Gt Go To Www Gov Form11s For Instructions And The Course Hero

Fill Free Fillable F4797 Accessible 19 Form 4797 Pdf Form

Irs Form 4797 Fill Out Printable Pdf Forms Online

What Is Form 4797 Tax Guide For Real Estate Investors Fortunebuilders

Basic Schedule D Instructions H R Block

Form 4797 Fill Out And Sign Printable Pdf Template Signnow

What You Need To Know About Form 4797 Millionacres

The So Called Tax Cuts And Jobs Act Of 17 Eliminated Deductibility Of Alimony For Divorces In 19 Conejo Valley Guide Conejo Valley Events

Section 1231 And Depreciation Recapture Use This I Chegg Com

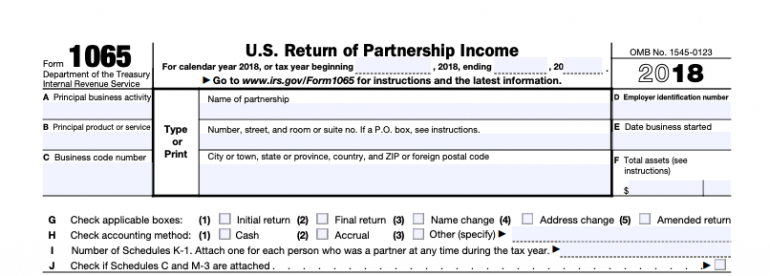

What Is Form 1065 Get Form Filing Instructions For

Schedule D

Irs Form 4797 Fill Out Printable Pdf Forms Online

Irs Form 4797 Instructions Fill Out And Sign Printable Pdf Template Signnow

Irs Form 1065 Instructions A Step By Step Guide Nerdwallet

Instructions For Form 1040 Uncle Fed S Tax Board

Form 6 A Worksheet Promotiontablecovers

Fill Free Fillable Irs Pdf Forms

Fill Free Fillable Sales Of Business Property Pdf Form

4797 Form Sales Of Business Property Omb No 1545 Chegg Com

Irs Gives Some Additional Information On Excess Business Loss And Nol Rules Current Federal Tax Developments

What Is Schedule D Here Is An Overview Of The Schedule

Irs Form 49 The Instructions To Fill It Right

Form 6252 Instructions 19 Fill Out And Sign Printable Pdf Template Signnow

U S Individual Income Tax Return Forms Instructions Tax Table F1040 I1040 I1040tt By Legibus Inc Issuu

Download Instructions For Irs Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Templateroller

Irs Restores Capital Gains Tax To Form 1040 And Other Tax Return Changes For

Instructions For Form 2106 Internal Revenue Service

Free 18 Printable Tax Forms

1040 Form Fillable Printable In Pdf

Instructions For Form 4562 Internal Revenue Service

Depreciation Recapture On Rental Property And Calculator Avoid The Painful Irs With A 1031 Exchange Inside The 1031 Exchange

Depreciation Forms 4562 4797 Youtube

Sale Of Business Assets What You Need To Know About Form 4797 Basics Beyond

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

Reporting Gambling Winnings Other Income On Schedule 1 Don T Mess With Taxes

Form 4797 Group Project Group 3 Form 4797 Department Of The Treasury Internal Revenue Service Sales Of Business Property Omb No 1545 0184 14 Also Course Hero

Irs Restores Capital Gains Tax To Form 1040 And Other Tax Return Changes For

4797 Form Sales Of Business Property Omb No 1545 Chegg Com

Sale Of Business Assets What You Need To Know About Form 4797 Basics Beyond

Calculation Of Gain Or Loss Section 1231 Gains An Chegg Com

4562 Listed Property Type 4562

What Are Real Estate Taxes Real Estate Tax Basics Millionacres

Irs Form 1040 Schedule 1 Download Fillable Pdf Or Fill Online Additional Income And Adjustments To Income Templateroller

Learn How To Fill The Form 4797 Sales Of Business Property Youtube

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

Form 4797 Sale Of Assets The Good The Bad And The Ugly

What Is Form 4797 Tax Guide For Real Estate Investors Fortunebuilders

Irs Form 4797 Fill Out Printable Pdf Forms Online

Irs Gives Some Additional Information On Excess Business Loss And Nol Rules Current Federal Tax Developments

Get To Know The New Tax Code While Filling Out This Year S 1040 The New York Times

Irs Reminder June 17 Is Next Deadline For Those Who Pay Estimated Taxes The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

Opportunity Zones Tax Returns How To

0 件のコメント:

コメントを投稿